Basis Multifamily Finance Closes Three Freddie Mac Loans for Texas Affordable Housing Refis Totaling $27.8 Million | Real Estate Weekly

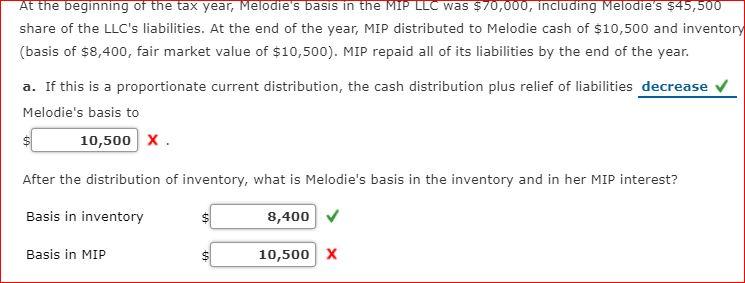

Required information Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in - Brainly.com

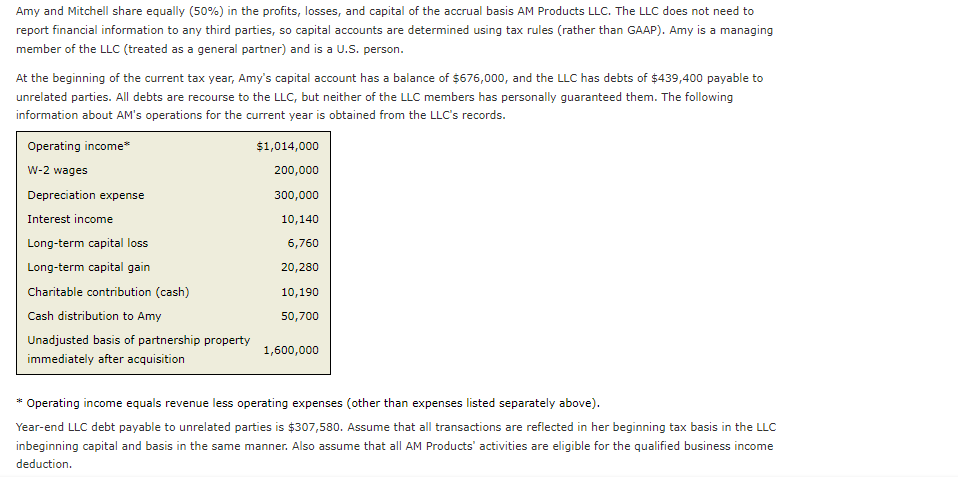

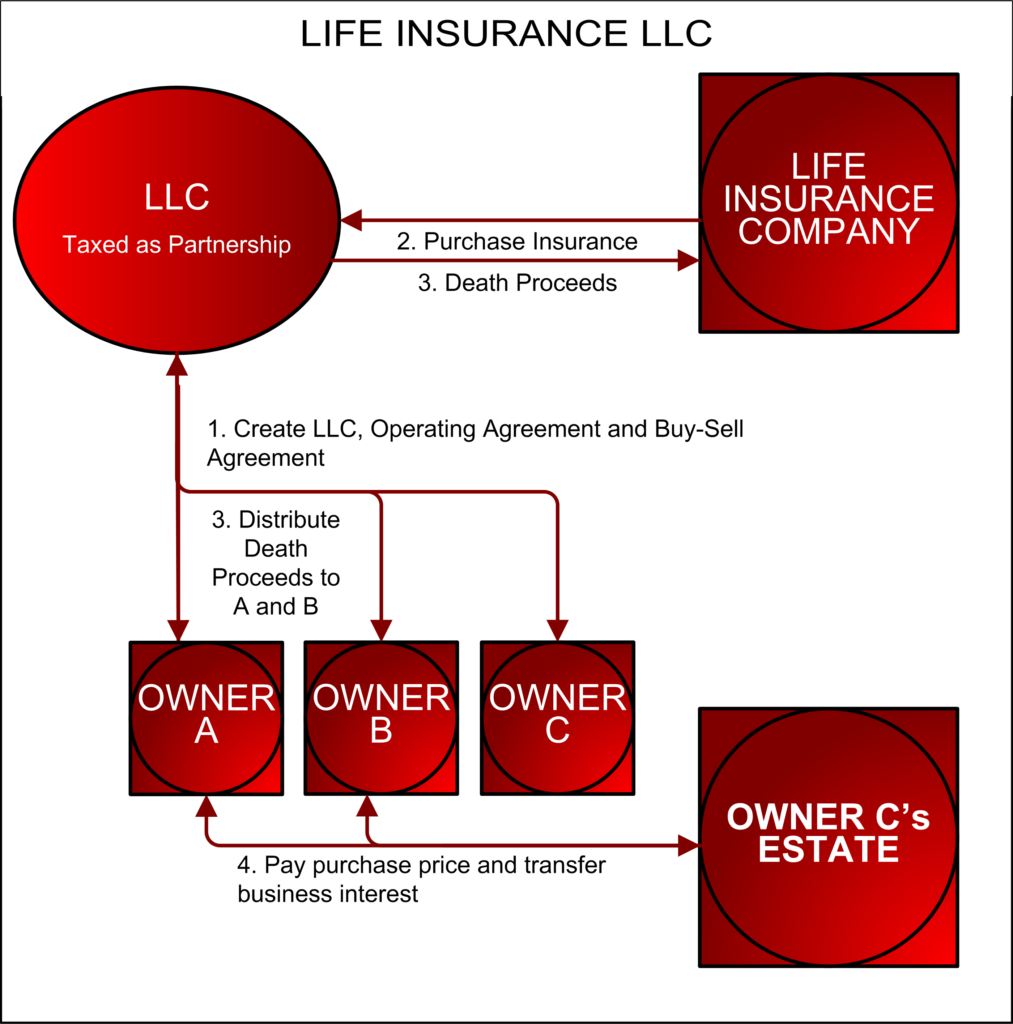

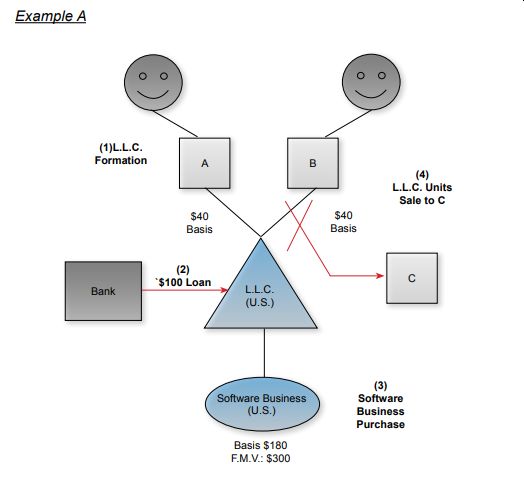

Tax 101: Tricky Issues When A Non-U.S. Person Invests In An L.L.C. Or Partnership Operating In The U.S. - Withholding Tax - United States

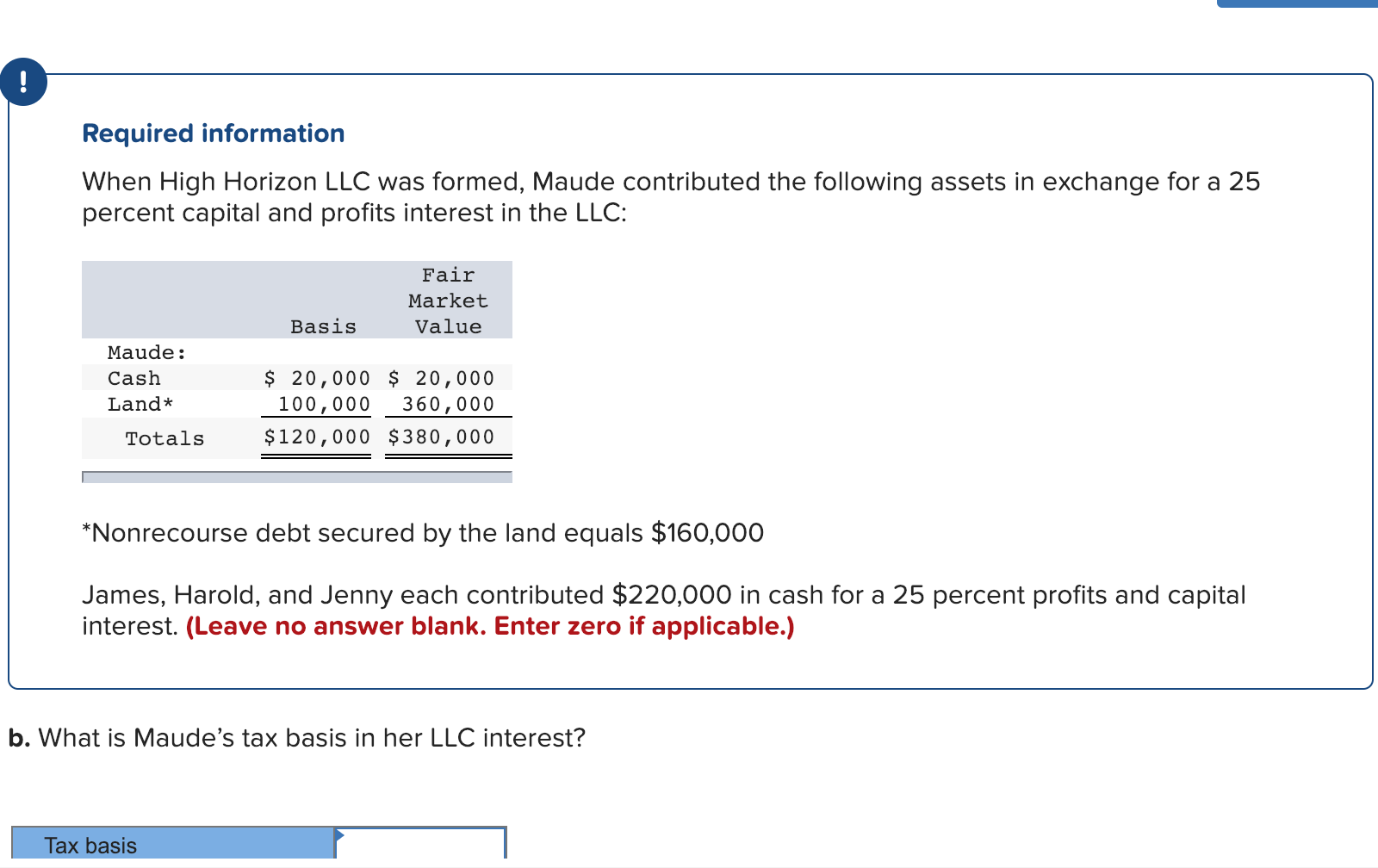

Committee on LLCs, Partnerships and Unincorporated Entities, Section of Business Law, ABA Capital Accounts & Basis. - ppt download

✓ Solved: LO.2 Franco owns a 60% interest in the Dulera LLC. On December 31 of the current tax year,...

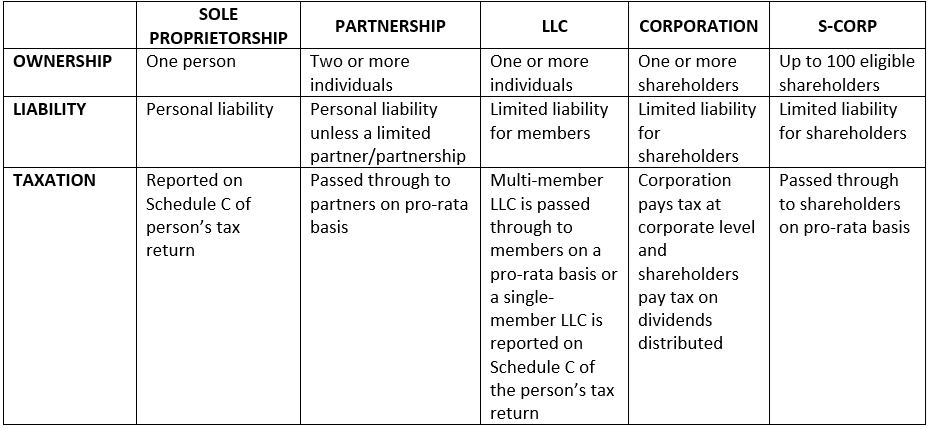

Calculating Adjusted Tax Basis in a Partnership or LLC: Understanding Inside vs. Outside Basis - Certified Tax Coach